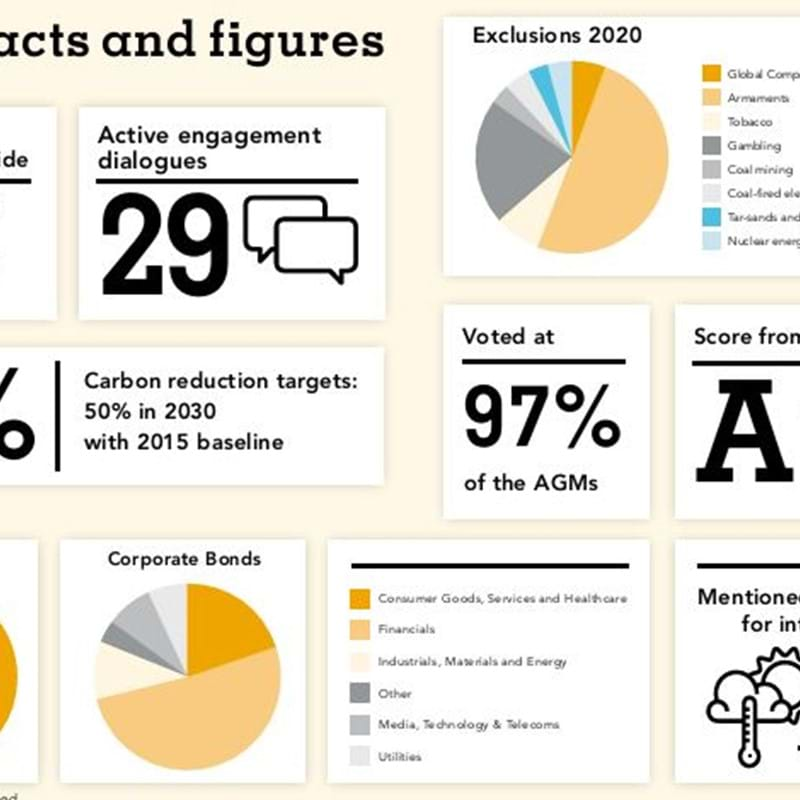

Ambitious carbon reduction targets

CO2 reduction plays an important role within our sustainability strategy. After prematurely achieving previously set CO2 reduction targets, we have once again included ambitious CO2 reduction targets in our sustainability strategy 2024 - 2027.

our sustainability strategy 2024 - 2027