© a.s.r. 2025

23 June 2021 | 2 min. readingtime

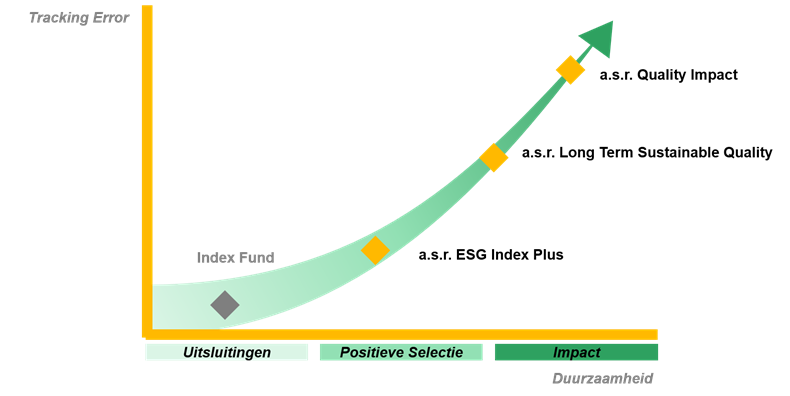

Launched in 2017, the IndexPlus strategy represents a total amount of EUR xx billion in invested assets as at 30 June 2021. This strategy is characterised by a broadly diversified portfolio that closely tracks its index. The IndexPlus products are available in fund form for the US and Europe regions. The IndexPlus investment strategy seeks to generate relatively better long term returns than the index, at a relatively lower risk.

The ASR Sustainable US Equity Fund and the ASR ESG IndexPlus Institutional Europe Equity Fund have sustainable investment as their objective, as referred to in Article 8 of the Sustainable Finance Disclosure Regulation (SFDR). The funds aim to reduce carbon emissions and promote the energy transition.

Also launched in 2017, this strategy entails investment in a concentrated group of sustainable quality businesses. While sharing a similar notion of sustainable quality with the IndexPlus strategy, the LTSQ strategy tracks its index less closely. The strategy is available in mandate form for the US and Europe regions. Since 2018, it has been available in fund form for the Netherlands region. The ASR Sustainable Institutional Dutch Equity Fund qualifies as a product that promotes environmental and/or social characteristics within the meaning of Article 8 of the SFDR, as a sustainability policy is applied when investment decisions are made.

The Long Term Quality Impact strategy kicked off in 2019. Investments qualifying for this strategy must meet the condition of impact as well as the condition of sustainable quality. There must be a causal relationship between the investment and the impact generated, for example. In determining this, we follow the Impact Investing Market Map produced by UNPRI and the variables set in that regard. This global strategy is also available in mandate form.