These are turbulent times for the financial markets, and for corporate bonds especially. We are witnessing historic changes, in multiple respects. We are seeing inflation figures that have not been seen in decades. Central banks have been forced to tighten their policies at high speed, which has sent interest rates rocketing. The new geopolitical reality created by the war has spurred governments to invest heavily in defence and accelerate the energy transition. How does all this affect corporate bonds?

At the end of June the ECB ended its bond buying programme, which had lasted for six years. This also spelled the end of a major driving force behind the corporate bond market. Redemptions within the ECB’s portfolio will still be reinvested for some time yet, but this is only a fraction of the amounts we have seen in the past few years.

The impact of the bond buying programme

The impact of six years of corporate bond buying has been considerable. The certainty of an ever present major buyer was like a safety net that the market had come to take for granted. Combined with very low interest rates, this was an attractive environment for companies to issue bonds. The market therefore not just grew strongly in size as a result, but also greatly expanded in ‘width’, measured in number of companies and loans.

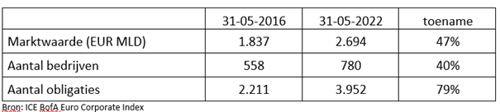

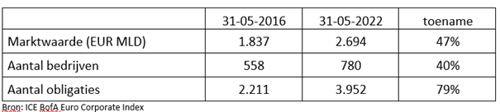

Here is some data of the broad corporate bond benchmark to illustrate this:

From a diversification point of view, the increase in the number of companies is obviously a good thing. We have seen many ‘Reverse Yankees’: US companies raising capital in EUR, whether or not from a European subsidiary.

Another striking development is the increase in the number of property bonds. While this sector still accounted for 2.8% of the benchmark in 2016, today that number has increased to over 6%. Property companies had no trouble meeting their high funding requirement with property bonds.

The proportion of bank bonds, on the other hand, dropped by 7%, in part because of the ECB’s ‘TLTRO’ programme, which enabled banks to borrow cheaply from the ECB. This reduced the need for banks to issue bonds.

A new era

Is there a turnaround in the offing? We think not. Companies have now found their way to the corporate bond market, and will continue to want to benefit from multiple funding sources instead of being dependent on a bank. But with the ECB out of the picture as a buyer, this will of course become a more costly business.

The ECB’s move comes at a delicate time, as major investments will be needed in the years ahead. The energy transition in particular springs to mind – Europe will need to switch to renewable energy more rapidly in order to cut loose from Russian gas. This means big expenditures not only for the energy sector but also, for example, for cable companies that will need to get the power grid ready, or renewable energy suppliers that will need to scale up their production capacity. To illustrate, it takes about 300 tonnes of steel and iron to build an onshore wind turbine.

We are also facing substantial changes in other areas. The geopolitical landscape has fundamentally changed as a result of rising tensions between the US and China, the coronavirus pandemic and Russia’s invasion of Ukraine.

Trade restrictions between China and the US have led to new policies with a stronger focus on ‘strategic decoupling’, i.e. independence in vital industries. This will have a massive impact on industries such as the technology sector, for example in the production of semiconductors and chips. In this vein, the EU introduced the ‘European Chips Act’ this year, which aspires overall R&D investment to the sum of 43 billion euros to prevent chip shortages in Europe, while Intel announced its intention to up its European investments to 80 billion euros.

Another example is the ‘European Battery Alliance’ for the production of batteries for the automotive industry as well as other sectors.

From ‘Just in Time’ to ‘Just in Case’?

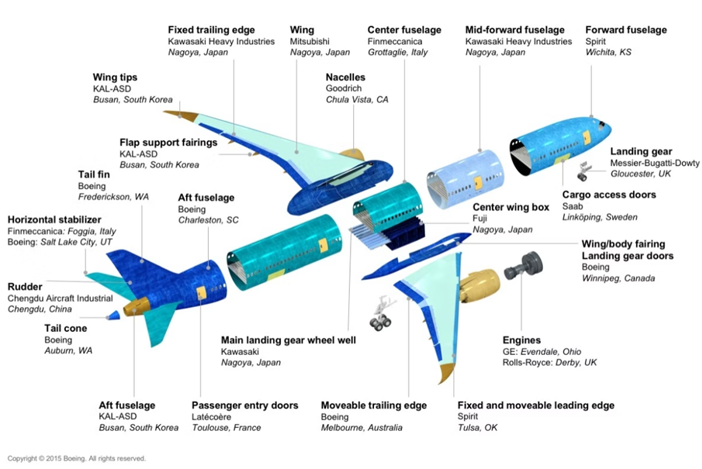

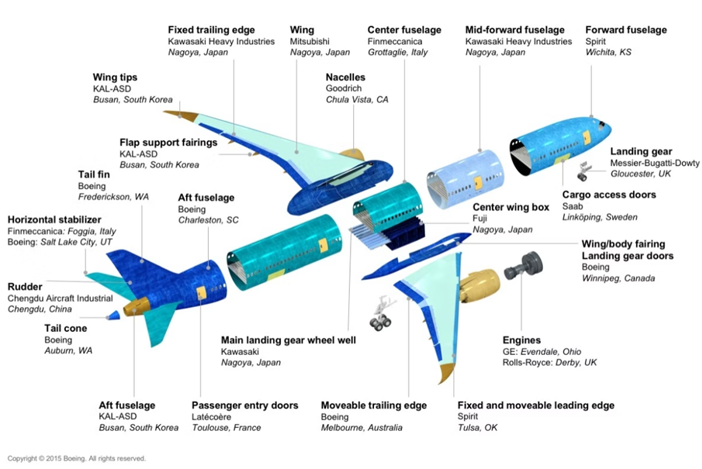

The COVID pandemic has opened companies’ eyes to the fact that the ‘Just in Time’ logistics practised in the past few decades also have a downside when supply chains are disrupted. Companies have in many cases created highly complex and fragmented logistics chains in their pursuit of keeping costs as low as possible. The Boeing picture below, which illustrates this, is even just a simplified representation of reality:

The logistics problems have been exacerbated even further by the war in Ukraine. The resulting sanctions on Russia brought a strong rise in energy prices and countless new logistical disruptions. For example, raw materials could suddenly no longer be imported from Russia, and car manufacturers faced supply issues trying to get wiring looms from Ukraine.

The above developments are very diverse and unpredictable by definition. It is therefore too early to say that the trend of globalisation will now suddenly reverse. What is certain, however, is that businesses will now critically assess the locations of their production and supply chains and, where necessary, spread them or move them to less risky areas. US companies, for example, are eyeing Mexico as an opportunity for ‘nearshoring’, whereas European companies look to countries such as India and Turkey.

A higher bill

It is clear that there are substantial investments to be made, especially in Europe. Governments will take on a major share but corporate spending will also increase, especially in specific sectors such as energy. In a world with rising interest rates and no central bank bond buying programmes, it will be more difficult to finance these investments. Eventually, both the underlying interest rate and the spread will be higher than in previous years. This raises the question: can companies afford these higher interest costs?

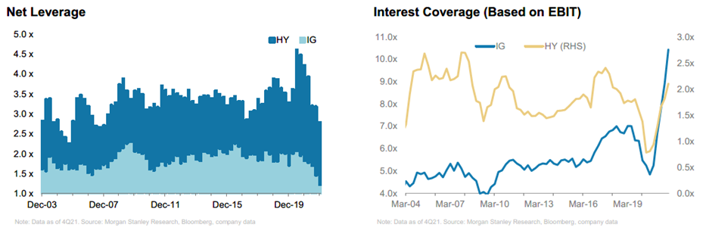

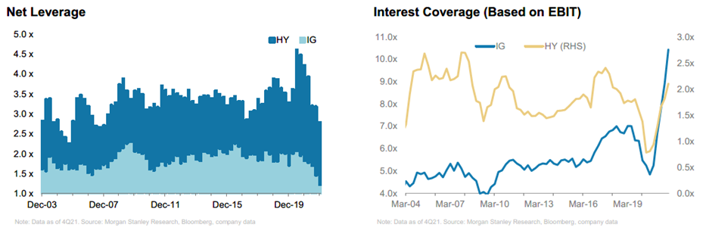

It is then reassuring to look at the fundamental strength of companies, which we are glad to say is very strong. During the pandemic years, businesses mostly pursued a very prudent policy, while earnings rebounded surprisingly strongly after the initial COVID shock. Investment grade companies’ debt currently stands at very low levels, against very strong interest coverage ratios (i.e. a company’s ability to pay its interest expenses using its profits).

Companies are heading for a challenging period with lots of investment required, in a world without support from the central banks. Geopolitical uncertainties will remain and a recession cannot be ruled out. This may put further pressure on spreads. At the same time, investment grade companies are fundamentally in good shape and should be able to weather the storm. All in all, caution is in order, but at the same time we see no reason for great concern either.

Read more on investing in bonds>>