Much has changed in the world in the past year. In the financial markets as well. Whereas last year and early this year we were still recovering from the coronavirus pandemic and there was plenty of stimulus to keep the economy afloat, we are now in a totally different world. The pandemic is more or less over and there is war in Europe. Inflation, volatility and geopolitical developments are dominating the financial markets. In response, central bank policy has rapidly reversed after years of low interest rates. A cocktail that has affected the credit market and the price companies pay for (re)financing their debt.

Troubled times, increased uncertainty

For businesses, as for consumers, these are turbulent times. Companies have been able to obtain finance at very low interest rates for years. Often in the knowledge that the ECB, through various buyback programmes, was buying up bonds in both the primary and secondary markets. This also provided security for investors. Indeed, the central bank ensured that volatility remained limited, and that credit spreads were less likely to widen significantly. This made investors willing to subscribe to new issues, which were placed in the market at only a small premium to existing loans.

Today, things are different. Investors want to be compensated for the greater uncertainty that they face today: high inflation, an upcoming recession (and whether this will be mild or severe), highly volatile credit spreads and government interest rates and the lack of a safety net in the form of the ECB. These factors obviously translate primarily into widening credit spreads, but also affect the so-called new issue premium, the (usually positive) difference between the spread of a new loan and the spread expected based on the already outstanding curve of the same issuer. Through this premium, investors are rewarded for subscribing in a new loan. At the same time, issuers are keen for a new issue to succeed. They are therefore willing to offer an additional premium to ensure sufficient interest among investors.

New issue premiums in the past two years

To illustrate this, we look at how new issue premiums have developed in the past two years. First some explanation: in general, there is an inverse relationship between the new issue premium and the oversubscription of the book. The oversubscription reflects how much interest there is in a loan. If investors have subscribed for €1bn and the loan principal is €500m, the oversubscription is 2x. If there is a lot of interest in a bond, the issuer does not have to pay much of a premium. On the other hand, if interest is low, the issuer has to pay a higher premium to make the issue successful. Another factor that helps determine the new issue premium is the volume of new loans coming to the market. If this is high, investors have a lot of choice and premiums tend to be higher.

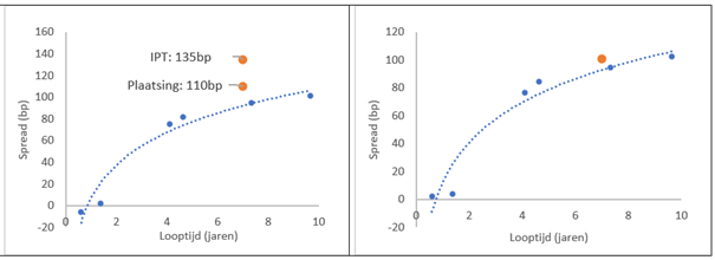

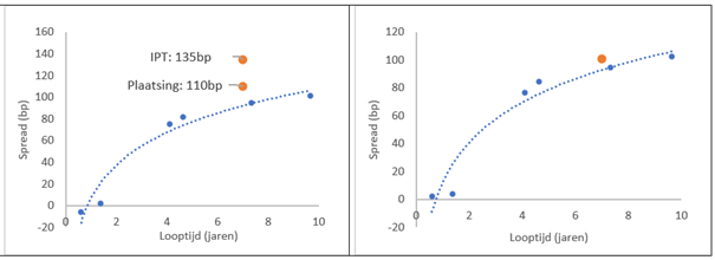

The graphs below show an example of the placement of a new loan. In this case, the issue is from Toronto Dominion Bank, which raised €1.25bn with a 7-year loan on 6 December. The left-hand graph in blue shows the curve of already outstanding loans on 6 December. The loan was marketed with an IPT (Initial Price Thought) of 135bp. This can be seen as the opening offer with which the syndicate of banks is putting the loan on the market. As more investors subscribe, the book fills up and is often oversubscribed. This offers potential to tighten the spread a little, in this case to 110bp. However, there is still space between the blue curve and the spread at which the loan was placed. This is the new issue premium. The interpolated blue curve was trading at 90bp, so the new issue premium was 20bp. The new loan is expected to move towards the curve of already outstanding loans, especially if the new issue premium and oversubscription are high, resulting in a higher price of the new loan. In the right-hand graph, we see the current situation. Here you can see that the new loan (in orange) has moved more towards the curve and is now trading at a tighter spread. This is the performance after placement.

Increasing premium

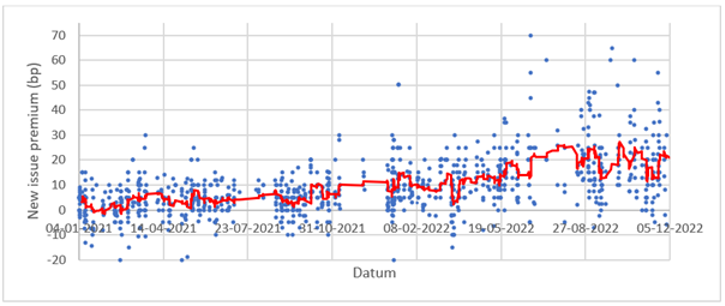

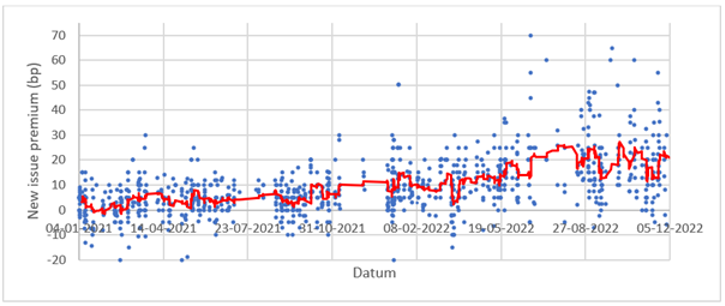

The graph below shows the new issue premiums of all senior investment grade issues in the euro market since the beginning of last year (both financials and non-financials), with the moving average shown in red. It can be clearly seen that the premium has been steadily rising. In 2021, the average premium was less than 4bp, while in 2022 it averaged more than 14bp. It is also noticeable that the spread compared to the average has increased. However, the increase in the premium cannot be explained by less oversubscription, which has remained fairly constant around 3x. Also, the volume of issues in 2022, measured in euros, is significantly lower than in 2021, especially for non-financials. Lower premiums would be the expected consequence of this, but this is not the case.

Compensation

The development of the new issue premium is thus indeed the consequence of the changed market conditions. Another factor is that we often see an issuer's existing curve widen sharply (to a higher credit spread) as soon as a new issue from that issuer is announced. Investors who already have loans on their books are thus penalised, so to speak. A higher new issue premium then offers these investors a form of compensation, should they choose to participate.

Opportunities

For us as investors, this market environment presents opportunities. High new issue premiums make it possible, for example, to swap an existing loan into a new issue for some extra yield. There are risks to this: it is not certain how much of a new loan we will be allocated and therefore how much of the existing loan will have to be sold. In addition, it is far from always the case these days that a loan with a high new issue premium is also going to perform. What we mean here is that the credit spread of a new loan after placement moves into line with that of existing loans, with the price of the new loan rising (assuming unchanged underlying interest rates). We therefore assess each new issue to determine whether a subscription will be worthwhile.